Corporations are also easier to invest in as compared to sole proprietorships and partnerships. For a sole proprietorship, the single owner of the business needs to bear all the capital requirements of its operations which makes it an expensive and risky form of a disadvantage of the corporate form of organization is investment. S corporations are similar to C-corps in that the owners have limited personal liability; however, they avoid the issue of double taxation. A corporation provides more personal asset liability protection to its owners than any other type of entity.

สารบัญ

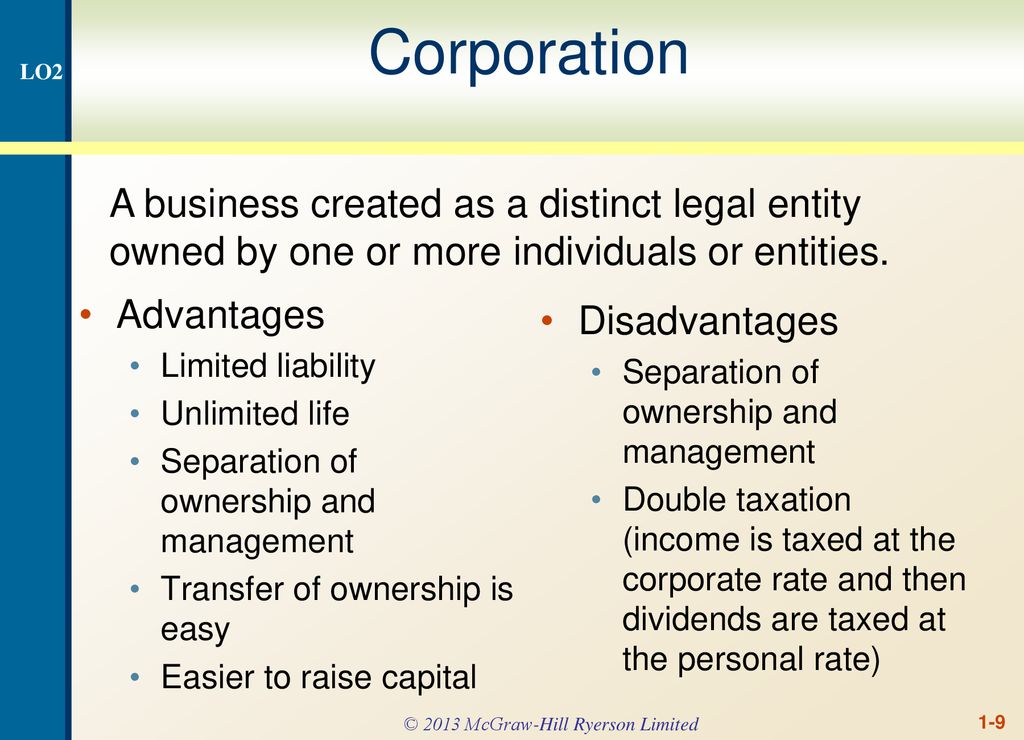

What are the disadvantages of forming a corporation?

Partnerships are bigger businesses as compared to sole proprietorships. Since most corporations sell ownership through publicly traded stock, they can easily raise funds by selling stock. This access to funding is a luxury that other entity types don’t have. It is great not only for growing a business but also for saving a corporation from going bankrupt in times of need. Small business owners have a variety of options when establishing a legal structure. Although there are several reasons why incorporating can be advantageous to your business, there are a few disadvantages to be aware of as well.

- Profits from the firm flow straight into the personal tax returns of the partners.

- In principle, stockholders control the corporation because they elect the directors.

- The bylaws may be amended or extended from time to time by the stockholders.

- Unlike other businesses, a corporation has no limit to its life.

- The stockholders elect the board of directors, who then select the managers.

Advantages of S Corporations

On tax returns, some employee benefits are not deductible from corporate revenue. It is possible that even if you started the corporation, a board could take control of the business, leaving you without a say. A board often has the ability to fire the founder and vote other board members out. Organizing your business as a corporation offers many advantages, but there are also disadvantages that must be considered. However, this may also create more administrative burdens and costs for corporations.

What are the advantages of forming a corporation?

There are many standards required by law on how a corporation governs itself. Corporations must have a board of directors, hold meetings at determined intervals, and keep certain records. If a corporation sells stock or has a membership, there are many other rules that apply. An interesting note about corporations is that as ownership dilutes it can become difficult for owners to provide insight or direction.

CorporationA business created as a distinct legal entity composed of one or more individuals or entities. You can form an S Corporation tax status to avoid double taxation. The shareholders who receive dividends must also pay taxes for this distribution on their personal returns. You should also consider the fact that if you form a corporation, there’s no guarantee that you will be able to maintain your standing in your business. The board of directors can take total control of your business, and you may find yourself forced out of the business that you founded. Incorporating your company can cost a great deal of money depending on the state where you plan for your business to operate.

Small Business Resources

The bylaws are rules describing how the corporation regulates its existence. These bylaws may be a simple statement of a few rules and procedures, or they may be quite extensive for a large corporation. The bylaws may be amended or extended from time to time by the stockholders. Starting a business is a big commitment of time, resources, and money.

Another disadvantage of forming a corporation is the double taxation requirement. C corporations pay taxes on profits when corporate income is distributed to owners (shareholders) in the form of dividends. If you are passionate about owning and operating your business, forming a corporation is usually a poor choice. Individuals cannot personally own a corporation, as these entities are separate from their owners. Also, a corporation is governed by a board of directors instead of an individual owner.

Corporations are more difficult to form as compared to other types of businesses. This is because corporations must comply with stricter rules as compared to other types of businesses. Similarly, there are several different stages that the initial owners of a corporation must go through to form a corporation. Its shareholders will only be liable for the corporation’s debts limited to the value of their shareholding or their capital invested in the corporation. Limited liability businesses are more lucrative to investors as investing in corporations ensures they don’t have to pay for any liabilities above their capital.

Aside from meeting state requirements, nonprofit corporations must obtain a tax exempt status from the IRS, and simply applying for this status costs $750. Some states require that nonprofit corporations apply for tax exempt status at both the state and the federal level. If your company is already dealing with a lack of funds, paying the various fees needed to form a nonprofit corporation can be very difficult, if not impossible.

Our editorial team independently evaluates products based on thousands of hours of research. We are committed to providing trustworthy advice for businesses. Learn more about our full process and see who our partners are here. See the reasons in this article to determine if the downsides are worth the rewards of forming a corporation.