Professional investors purchase a lot of fun selecting holds and you can ties so you can manage better-well-balanced financing portfolios. It’s a challenging jobs that requires solutions and plenty of search to get it proper. Mutual fund get this sort of specialist government open to regular traders, to own a good commission. Fidelity might have been a mutual finance supplier for a long time, also to the advantage of money investors industrywide it’s been a champion of reduced charge. Fidelity International Directory Finance’s lowest debts proportion will make it hard to own opponents to surpass forex trading-cap-weighted index money. Common financing take on money from people and use that cash to invest in many different property.

What is Time Exchange? Meaning, Info, Pros, Drawbacks

To identify the newest ten finest mutual finance, i screened the brand new roughly 10,100 money available for those who work in the big 33.2% of output more a variety of about three, five and 10 years. Financing fund give buyers which have a professionally handled profile of investments that might help traders develop their cash throughout the years. They are often become whenever people pool their cash along with her to shop for more categories of investment than just they may by themselves. The fresh people up coming discover a lot of shares from the money showing exactly how much it provided. The fresh shares’ well worth may go along according to a sort of issues, for instance the conclusion of other investors and the worth of the fresh investment from the finance. Just like most other opportunities, shares of your own investment finance might be used for the money because of the the new investor.

Medical care Money

The newest ties away from quicker, reduced well known companies could be more volatile than those of large organizations. Other long-time player who’s implemented the fresh S&P five-hundred while the their the beginning in the 2000 ‘s the iShares Core S&P five hundred ETF. It’s one of the greatest ETFs and that is supported by one of several heavyweights in the business, BlackRock. We come across the market industry’s nuts shifts shorter if we beginning to think go out horizons that will be longer than one 12 months. Looking at the step one-year look at, we come across loads of purple, definition there were lots of decades where the field is down. Naturally, appearing beyond Fidelity for the best S&P five-hundred index financing doesn’t suggest you’ll need to pay a supply and a toes for certain small potatoes providing.

The new list vendor otherwise coach assessment of a pals, in accordance with the organization’s amount of wedding inside the a specific world or their particular ESG conditions, may differ from compared to other portfolios otherwise a keen investor’s analysis of these company. As a result, the businesses deemed qualified by the index vendor or coach can get maybe not mirror the new values and values of any sort of individual and you can certain microsoft windows will most likely not showcase positive otherwise https://predictwallstreet.com/project/treasure-flow-systems favorable ESG services. The brand new research from businesses to own ESG screening or consolidation is reliant for the punctual and you will precise revealing out of ESG investigation by the enterprises. The brand new advisor is almost certainly not effective inside the evaluating and you will pinpointing companies which have otherwise are certain to get a positive effect otherwise help a good considering reputation. In certain things, companies you will sooner or later features a negative if any feeling or support away from confirmed status. The extra weight provided to ESG issues to have productive low-ESG finance may differ across type of investments, marketplaces, nations and you can issuers; can get change over day; and never all the ESG grounds could be identified otherwise evaluated.

Restricting access to private borrowing relationship investigation doesn’t let customers, enable the chartering away from de novo establishments, otherwise get rid of regulating load to your short cooperatives, which have been exempt regarding the demands to help you declaration this type of research. More a few dozen vocabulary groups to profit of $540,100 within the grant fundsThe Town of Seattle try thrilled to declare the newest yearly Tech Complimentary Fund (TMF) prize users to own 2025. This season, 14 neighborhood groups are certain to get $540,100 inside the TMF prizes to provide digital guarantee applications and you will characteristics to Seattle people facing barriers so you can opening and making use of tech. How many index fund you own is always to confidence how varied the individuals indexes is. For many who invest in very varied fund, you may also just need one to two.

Just how Fund Performs

Our very own final number provided that money you to overcome competitor class output more 10 years, and some funds that can outperformed the directory productivity. For the you to definitely fund that isn’t ten years dated, we insisted on the outperformance as opposed to its class average while the inception. SWPPX’s 10-year mediocre annual go back above 12% beats the Morningstar group’s average. The newest finance’s zero minimal first investment needs reveals SWPPX to the minuscule investors. Buyers worried about losing efficiency whenever investing in ESG will be delighted one to FITLX’s mediocre yearly output exceeded its Morningstar large-limit combine group average before you to definitely, around three and you may 5 years.

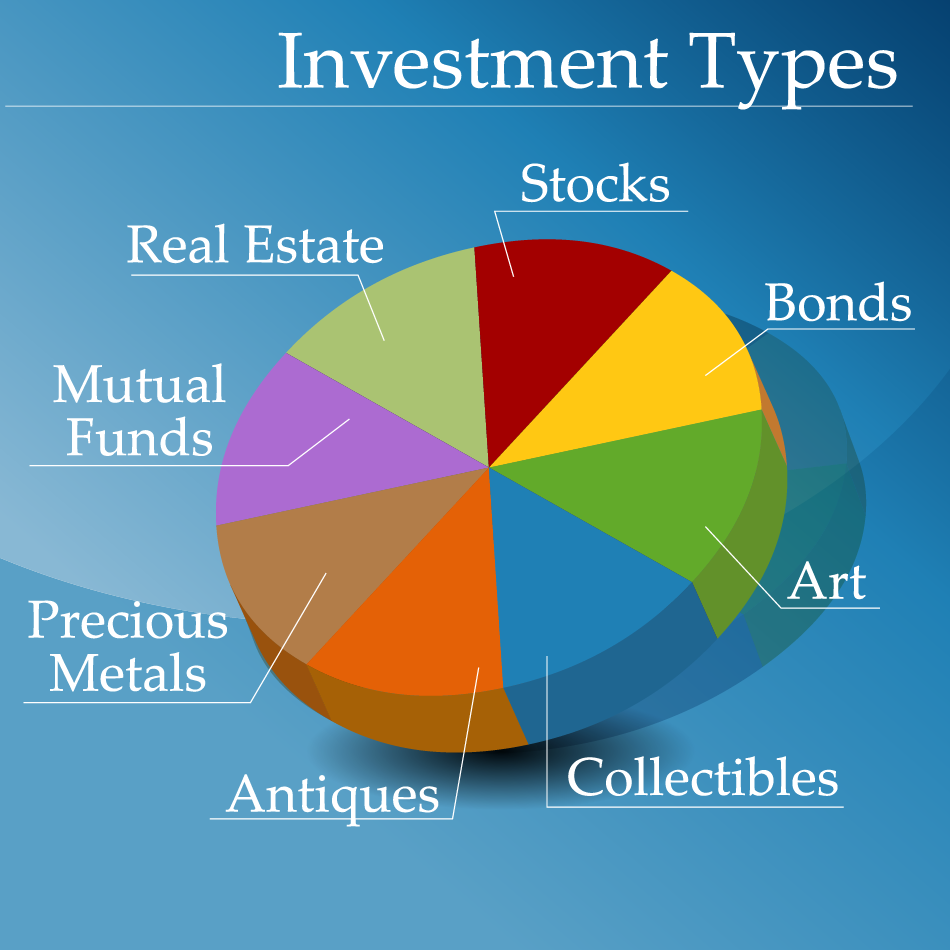

Fidelity Intermediate Civil Income Financing targets bonds which have a buck-weighted average maturity between about three and you can ten years. Normally, no less than 80% of its ties is actually money degree and make money which is exempt of government taxes. The 2.57% yield is the same as a great step 3.836% nonexempt yield to own married shared filing taxpayers on the 24% bracket. Financing parts include a variety of assets but are essentially carries and you can bonds. We desire the new NCUA Chair in order to prioritize transparency also to continue the practice of quarterly reporting and you will public revelation from overdraft and you may NSF percentage money to own personal credit unions. I enjoy carried on to do business with the complete NCUA Board to guard users and also the credit relationship program.

The newest investing suggestions given in this post is for informative motives simply. NerdWallet, Inc. doesn’t render advisory otherwise broker functions, nor will it recommend or recommend investors to find or offer kind of holds, bonds or other investment. For each and every condition-certain class comes with enough time, intermediate, and you may small stage thread financing. The amount of money away from all condition-particular finance can be exempt of state and federal fees. Indexing seeks so you can mirror the danger and you will come back of your complete field to the theory your industry usually surpass one stock picker over the long-term.